- Governor Hobbs’ proposed budget directs new funding to Colorado River protection.

- Lawmakers introduced tax relief bills tied to irrigation and ranching infrastructure.

- A new proposal would expand the use of brackish groundwater as a future supply.

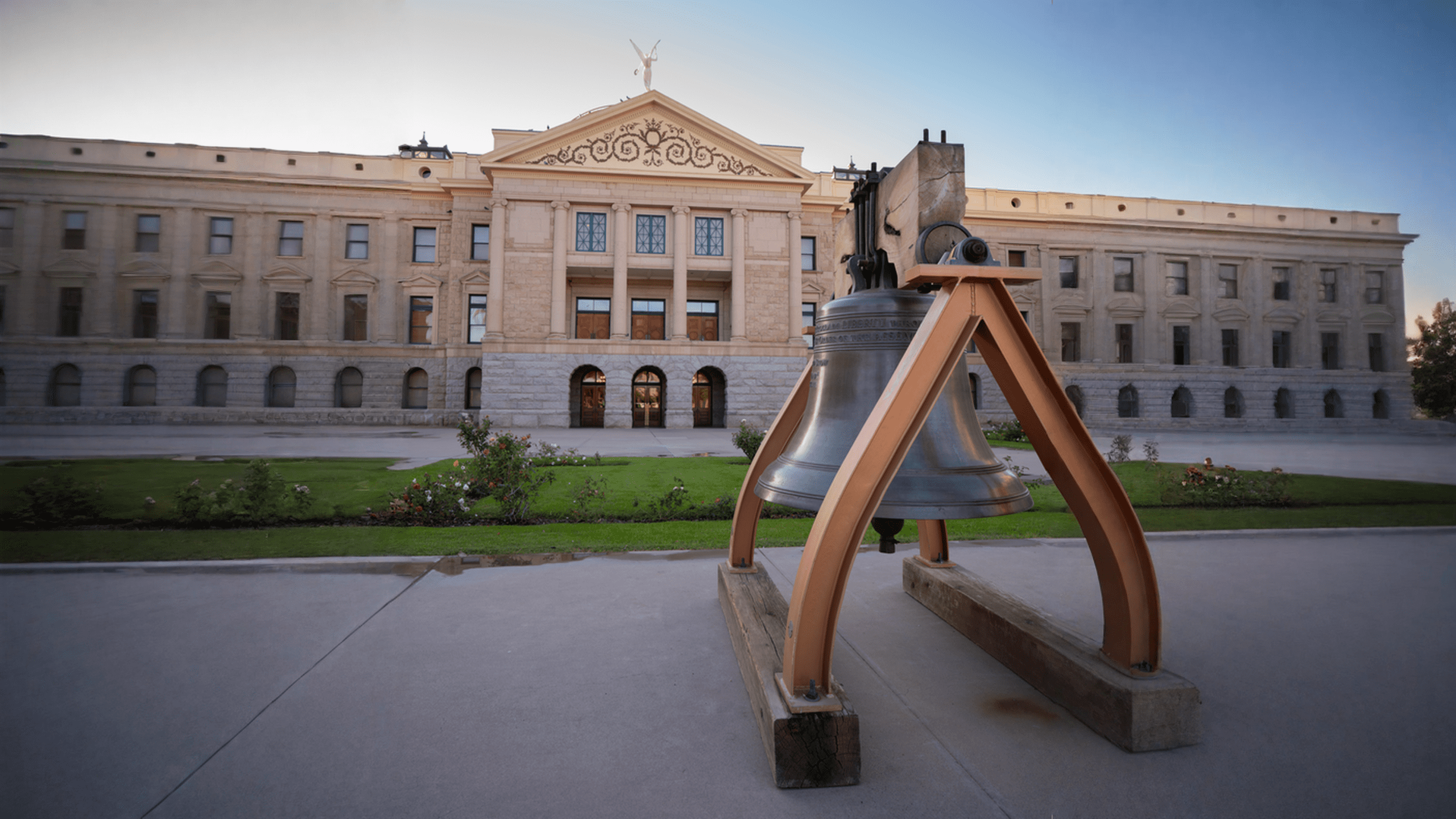

Tuesday, January 20, 2026 — Arizona entered 2026 facing continued pressure on its water supplies and rising costs for farmers and ranchers. In January, state leaders advanced a series of budget proposals and bills that address water conservation, long-term supply planning, and the cost of maintaining agricultural infrastructure. Together, these measures reflect how closely water policy and food production are linked in the state.

Governor’s Budget Focuses on Colorado River Protection.

Governor Katie Hobbs has released her fiscal year 2026-2027 executive budget proposal . The plan includes funding for several Arizona Department of Water Resources programs focused on conservation, water use reductions, infrastructure upgrades, and preparation for potential Colorado River shortages.

. The plan includes funding for several Arizona Department of Water Resources programs focused on conservation, water use reductions, infrastructure upgrades, and preparation for potential Colorado River shortages.

A key feature of the proposal is a $30 million one-time deposit into the newly created Colorado River Protection Fund. The budget also calls for permanent funding for the same fund through a water usage fee assessed on data centers and administered by the Arizona Department of Water Resources.

State officials emphasized that the funding is intended to help Arizona manage anticipated reductions in Colorado River supplies. The river provides roughly 40 percent of the state’s water, and Arizona’s annual entitlement totals about 2.8 million acre-feet.

The current federal guidelines governing the operation of the Colorado River system expire at the end of 2026. Arizona and the other six basin states are negotiating with the federal Bureau of Reclamation on a new framework for post-2026 operations. State leaders have acknowledged that if negotiations fail, litigation among basin states remains a possibility. The budget proposal includes resources to support Arizona’s participation in negotiations and, if necessary, legal defense of its water rights.

Canal Lining Bill Targets Irrigation Efficiency.

On January 16, 2026, Representative Chris Lopez introduced House Bill 2826, commonly referred to as the “No Tax on Concrete” bill. The proposal would eliminate the state transaction privilege tax on prime contracting for concrete and other materials used to improve and maintain irrigation canals on agricultural lands.

The proposal would eliminate the state transaction privilege tax on prime contracting for concrete and other materials used to improve and maintain irrigation canals on agricultural lands.

Supporters argue that concrete-lined canals significantly reduce water losses compared to earthen canals, where seepage into permeable soils can account for 30 to 50 percent or more of conveyed water. Lined canals move water more efficiently, reduce erosion and weed growth, and lower long-term maintenance costs.

The bill applies to materials used in ditches, pipelines, and canals when the purpose is improving irrigation efficiency and conserving water. Projects supported by the Water Infrastructure Finance Authority of Arizona have estimated lifetime water savings ranging from more than 135,000 to nearly 370,000 acre-feet, depending on the district and project scope.

Backers of the legislation describe canal lining as one of the most cost-effective water conservation tools available to the state, with estimated costs of roughly two to three dollars per acre-foot saved over a project’s life.

describe canal lining as one of the most cost-effective water conservation tools available to the state, with estimated costs of roughly two to three dollars per acre-foot saved over a project’s life.

Ranching Infrastructure Tax Relief Proposal.

Earlier in the month, on January 8, 2026, Representative Lopez introduced House Bill 2152 , known as the “No Tax on Troughs” bill.

, known as the “No Tax on Troughs” bill. This proposal would remove the state transaction privilege tax on water-related infrastructure improvements used on public and private grazing lands.

This proposal would remove the state transaction privilege tax on water-related infrastructure improvements used on public and private grazing lands.

Covered improvements include fencing, fence posts, drinking troughs, water lines, and storage tanks. Ranchers typically pay for this infrastructure even when it is installed on federal grazing lands, where ownership of the improvements transfers to the federal government after installation.

Supporters say eliminating the tax would lower operating costs for ranchers facing higher expenses for fencing and water delivery, costs that are often passed on to consumers through higher beef prices. The bill also highlights the role ranching infrastructure can play in supporting wildlife by providing reliable water sources across large landscapes.

Brackish Groundwater Enters the Policy Conversation.

Another proposal moving through the Legislature is House Bill 2055, which would establish a brackish groundwater recovery program. Brackish groundwater is water that is saltier than freshwater but less saline than seawater and is generally unsuitable for direct use without treatment.

Brackish groundwater is water that is saltier than freshwater but less saline than seawater and is generally unsuitable for direct use without treatment.

The bill would allow the Water Infrastructure Finance Authority of Arizona to use funds from the state’s long-term water augmentation program to help develop brackish groundwater recovery and desalination projects within Arizona. Funding would be provided as matching dollars, with the state contributing up to one dollar for every three dollars of total project costs.

Under the proposal, projects would be evaluated based on cost effectiveness, long-term reliability, impacts to regional aquifers, and effects on nearby water users. The program would also require detailed plans for brine disposal, a key issue in desalination projects.

Supporters view brackish groundwater as a potential future supply that could reduce pressure on rivers and freshwater aquifers. Opponents have raised concerns about costs, energy use, and local impacts, issues that would be considered during project review.